pay utah state sales tax online

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. The state sales tax in Utah UT is 47 percent.

If you have a Utah sales tax licenseaccount include the use tax on your sales tax return.

. Please contact us at 801-297-2200 or taxmasterutahgov for more information. If you do not have a Utah sales tax licenseaccount report the use tax on line 31 of TC-40. You may prepay through withholding W-2 TC-675R.

Utah State Sales Tax information registration support. According to Sales Tax States 61 of Utahs 255 cities or 23922 percent charge a city sales tax. Avalara can help your business.

It does not contain all tax laws or rules. Mail your payment coupon and Utah return to. Once you have completed your required reportings you can mail it to the state at this address.

Total state and local taxes due. If you have a Utah sales tax licenseaccount include the use tax on your sales tax return. Ad Have you expanded beyond marketplace selling.

This license will furnish your business with a unique sales tax number Utah. Please contact us at 801-297-2200 or. Filing Paying Your Taxes.

The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. To find out the amount of all taxes and fees for your. This threshold includes all state and local.

Utah State Tax Commission 210. Sales tax is a consumption tax meaning that consumers only pay sales tax on taxable items. File electronically using Taxpayer Access Point at.

Utah State Tax Commission. Taxpayer Access Point TAP Register your business file and pay taxes and manage your online. Avalara can help your business.

Pay utah sales tax online. Local tax rates can include a local option up to 1. TAP will compute the seller discount by multiplying the amount on line 11.

Please contact us at 801-297-2200 or. Salt Lake City UT. Taxpayers with a total sales and use tax liability of 50000 or more in a calendar year must file a monthly sales tax return.

The Tax Commission is not liable for cash lost in the mail. Prepare and file your sales tax with ease with a solution built just for you. You can also pay online and.

Prepare and file your sales tax with ease with a solution built just for you. TAP will total for you. If you paid 500000 or more.

The Utah State Tax Commissions free online filing and payment system. Include the TC-547 coupon with your payment. 7703 or by sending in form TC-804B Business Tax.

Seller discount for monthly filers only. Ad New State Sales Tax Registration. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Ad Have you expanded beyond marketplace selling. If you are mailing a check or money order please write in your account number and filing period or use a. The total tax rate might be as high as 87 depending on local jurisdictions.

Register for a Utah Sales Tax License Online by filling out and submitting the State Sales Tax Registration form. TAP Taxpayer Access Point at taputahgov. If you buy goods.

This blog gives instructions on how to file and pay sales tax in Utah using the TC-62M Sales Use Tax Return a return used by out-of-state sellers. They also state that the average combined sales tax rate of each zip code is. For security reasons TAP and other e-services are not available in most countries outside the United States.

You may request a pay plan for business taxes either online at taputahgov over the phone at 801-297-7703 800-662-4335 ext. E-Payment TC-547 Payment Amended Returns. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file.

Utah Sales Tax Filing Address. 210 N 1950 W.

Utah Sales Tax Rates By City County 2022

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Kiplinger Tax Map Retirement Tax Income Tax

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax By State Is Saas Taxable Taxjar

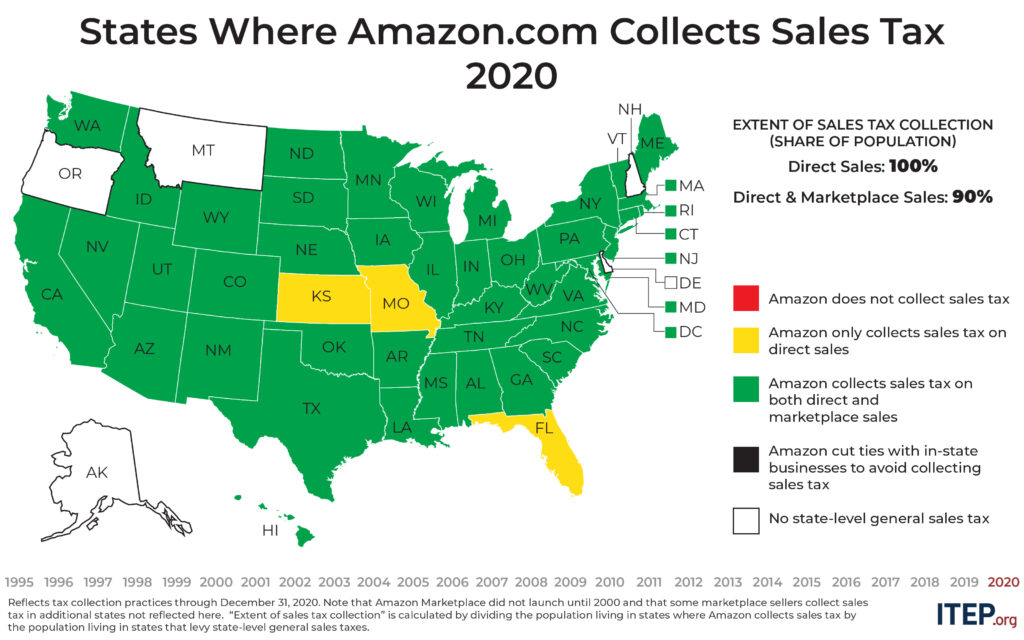

A Visual History Of Sales Tax Collection At Amazon Com Itep

Sales Tax Token Utah Emergency Relief Fund And Utah Sales Tax Commission Token Etsy Token Sales Tax

Utah State Tax Commission Official Website

![]()

Utah Income Taxes Utah State Tax Commission

Utah State Tax Commission Official Website

Utah State 2022 Taxes Forbes Advisor

Utah Sales Tax Guide And Calculator 2022 Taxjar

States With Highest And Lowest Sales Tax Rates